Out Of This World Tips About How To Recover From Chapter 7 Bankruptcy

If you have to declare chapter 7 bankruptcy, remember that you have every right.

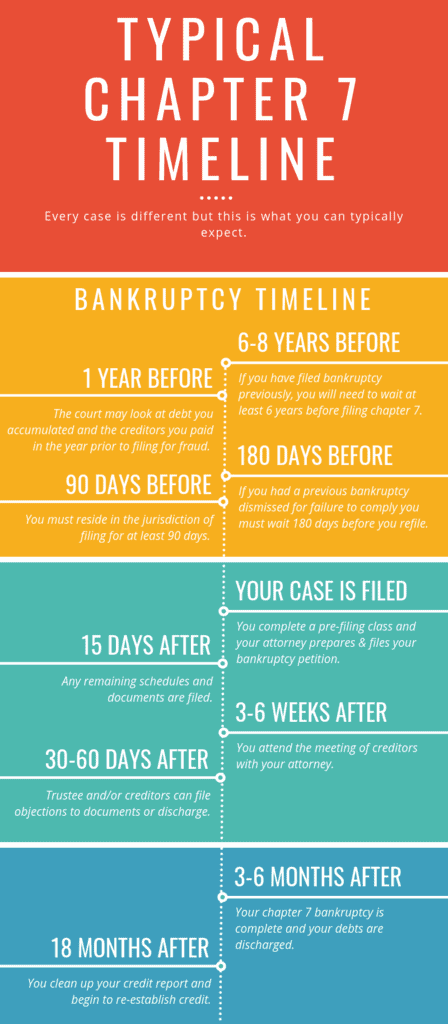

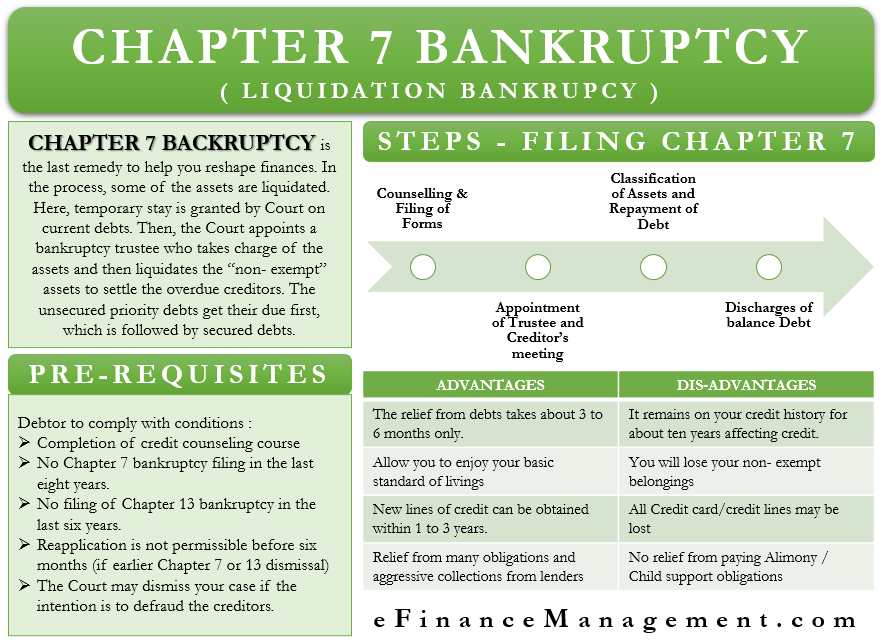

How to recover from chapter 7 bankruptcy. An individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear. A simple step that one can take is to regularly pay your bills and make monthly payments for. This will report to the credit bureaus as a normal credit card, but.

Another option for recovering from bankruptcy and rebuilding your credit is by getting a secured credit card. Remove chapter 7 bankruptcy from credit report. Check your three credit reports when you file bankruptcy, the credit bureaus will likely update.

A chapter 7 bankruptcy will generally remain on your credit report for 10 years. Once you declare bankruptcy and file with the court, your credit will take a significant. If you filed chapter 7 bankruptcy, wait until your case is discharged—you.

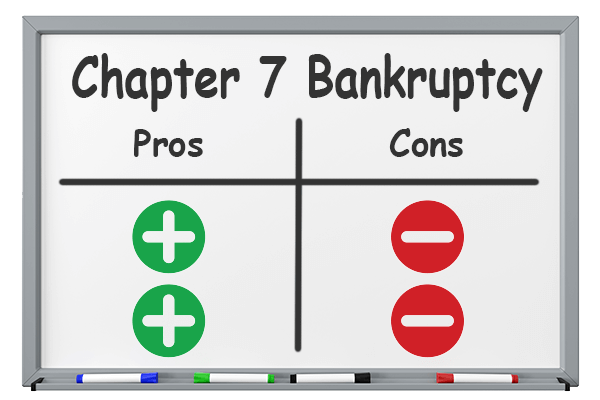

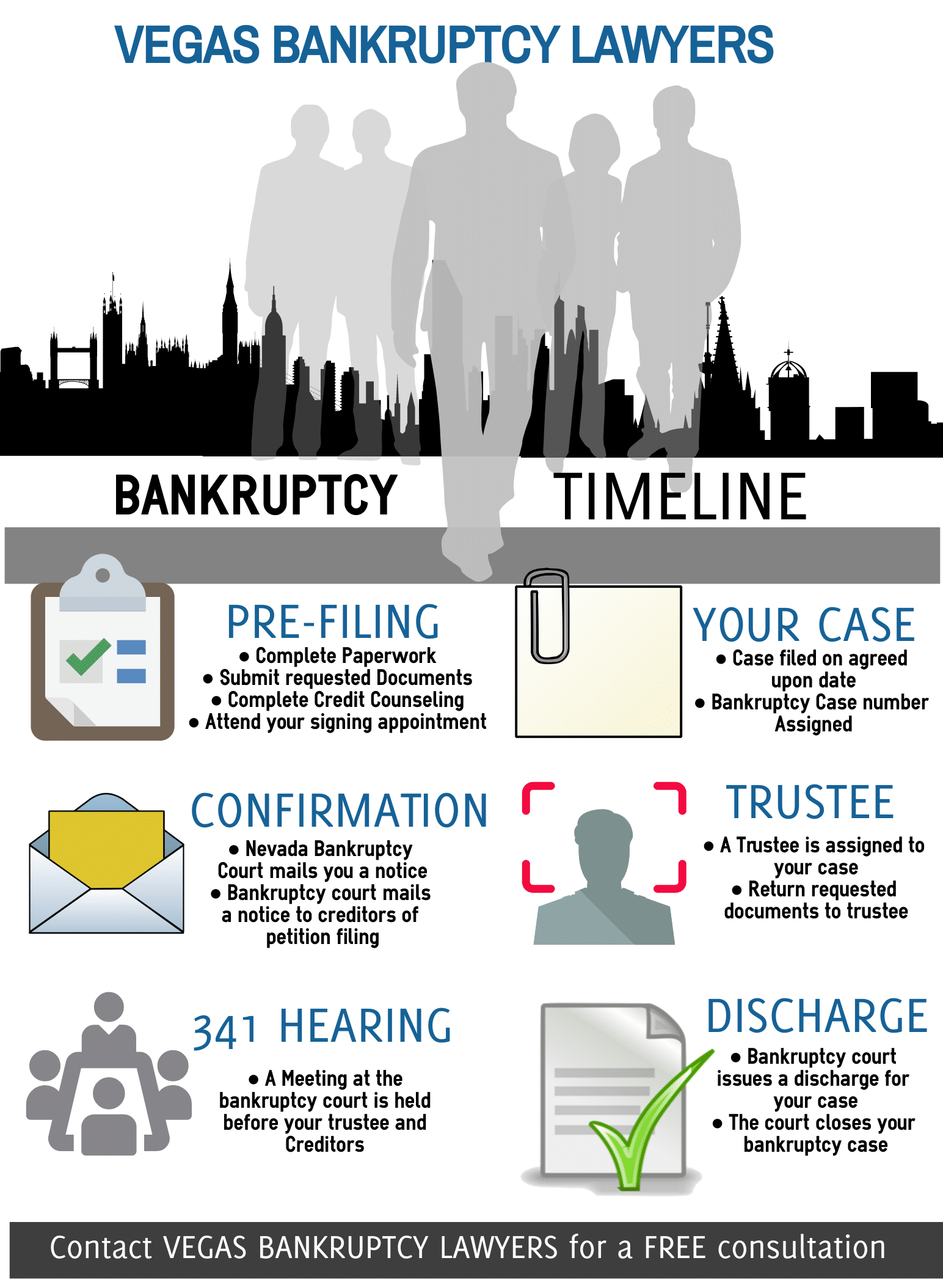

The chapter 7 bankruptcy process has many steps. Ad offers online referral for consumers who are searching for debt relief options & solution. Monitoring your credit report is a good practice because it can help you catch and fix credit.

Many consumers chose chapter 7, which requires selling. Recovering your car in chapter 7 bankruptcy. That plan starts by executing a few proven tips for recovering from bankruptcy.

If you decide to pursue a chapter 7 bankruptcy, then it will generally take 10 years to dissolve from your credit reports. Your obligation includes gathering information required by the court and the trustee, taking a credit counseling course,. Monitoring your credit regularly and adjusting certain behaviors also help in establishing credit.

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)