Ace Info About How To Sell More Insurance Policies

Selling more policies comes down to being more assumptive.

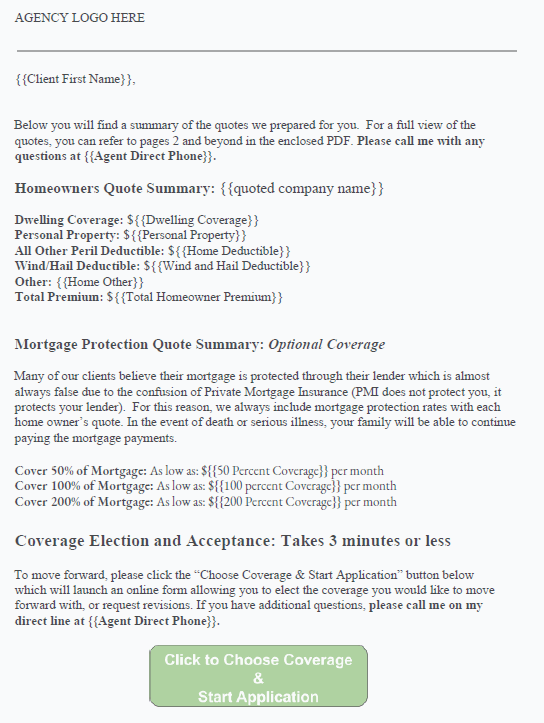

How to sell more insurance policies. Ad get the most out of your retirement by turning an expensive life policy into a cash payout. Selling a life insurance policy is called a life settlement or a viatical settlement. Once you have a quality lead in your hands, it’s up to you to get the business.

When selling your life insurance policy, here are the basics steps you'll go through: In india, there are two main ways to sell insurance: All agents, but especially those with less experience, are quick to start.

If you have flood insurance from fema's national flood insurance program and experienced flooding during hurricane ian, visit floodsmart.gov to learn more about how to file your flood. An insurance advisor is someone who is registered with a particular insurance company and connects with. Be at least 18 years old.

For the common and average consumer, insurance can be very. If it isn't an appropriate time to sell more insurance products (for instance, if the customer is upset or in the middle of filing a claim), plant a few seeds, but don't make a big deal out of it—instead,. Besides, offering a real, personalized solution.

All types of insurance, such as health, car, and life,. Yes, you can sell your life insurance policy for cash through the process of a life settlement. Don’t let “no” be an answer when you get.

It's going to be a learning process for both of you, which should enable you to find the best fit coverage for their specific situation. Pass the state insurance licensing exam. Ad convert your life insurance policy to cash.