Have A Info About How To Become An Accountant In Canada

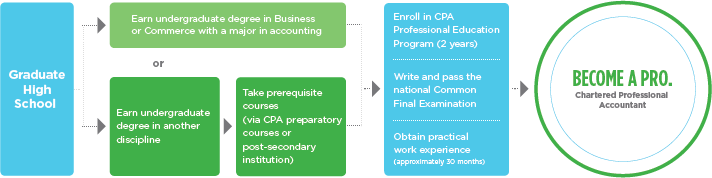

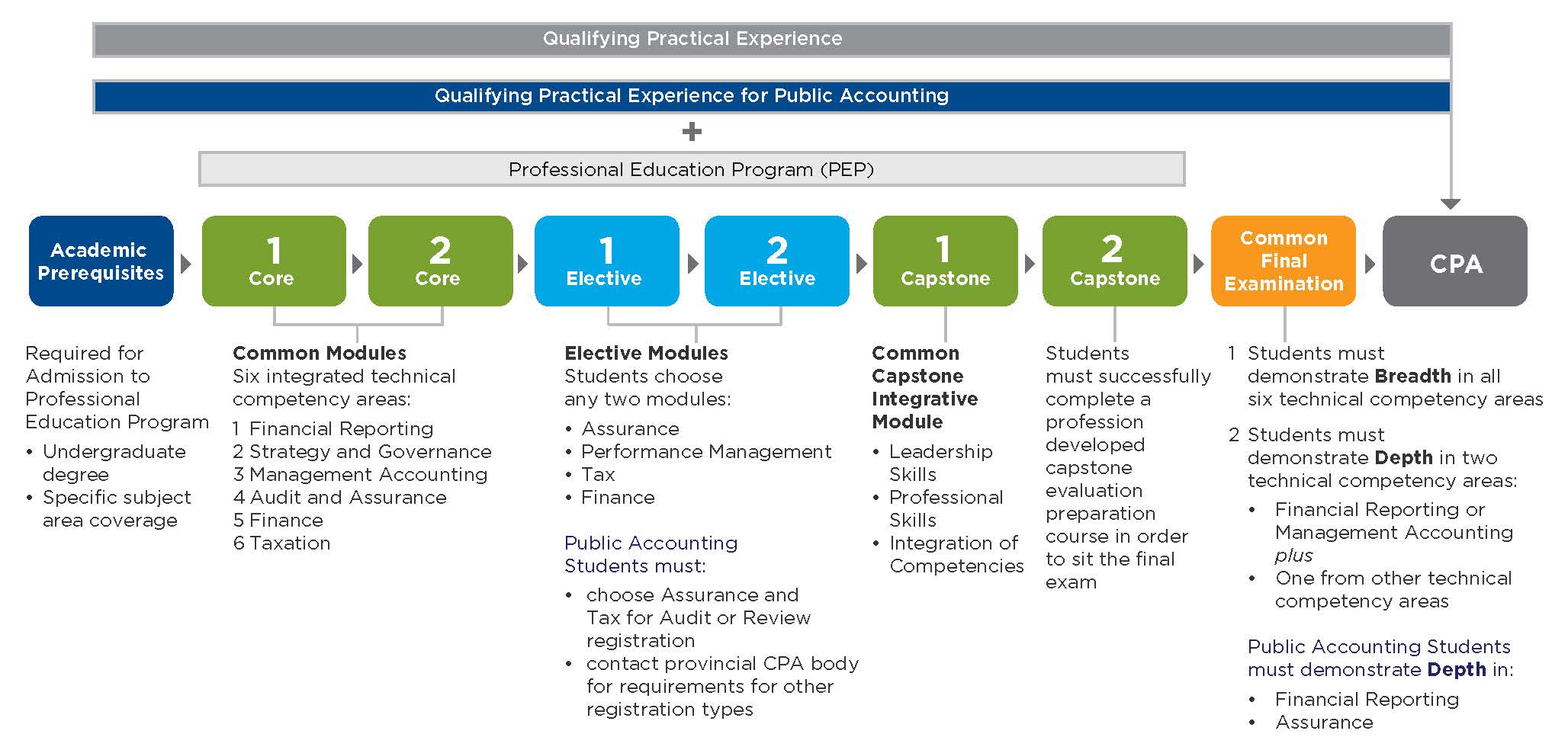

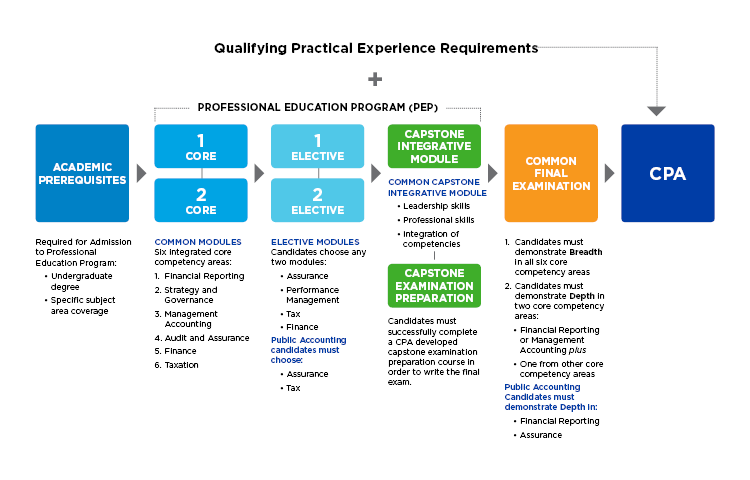

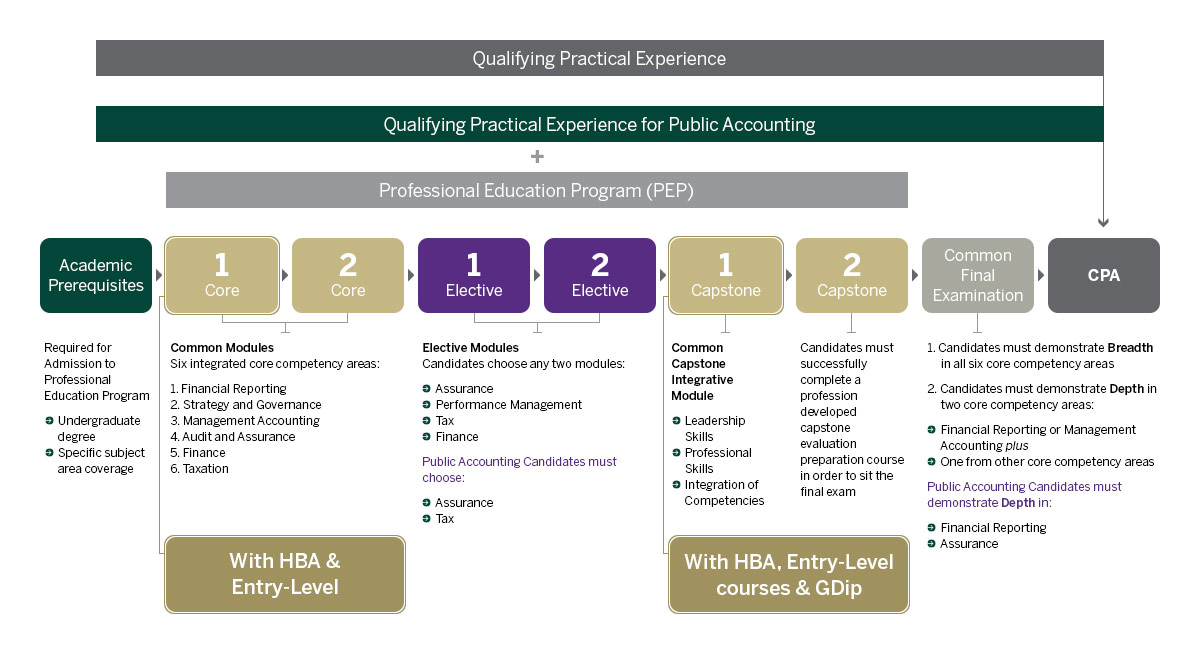

The process by which one becomes a chartered accountant in canada consists of four major components:

How to become an accountant in canada. Wes credential evaluations for cpas: The chartered accountants (ca), designation requires a bachelor’s degree, specialized graduate education through the canada school of business (casb), three years of experience and. The first option is to complete a master’s of business administration (mba) to further specialize in a specific field of accounting.

Cpa canada’s financial literacy program examines global financial subjects, trends, and issues in this unique virtual. First, canada cpa candidates must have an undergraduate education in certain related subject matters. Ontario college accounting programs require an ontario secondary school diploma (ossd) or equivalent, with emphasis on mathematics courses.

You will need a bachelor’s degree to. Prerequisite undergraduate education consists of earning a. In order to become a chartered accountant, an applicant must have the following.

Enroll in an accounting program accounting programs in canada support the concept that accountants should learn how their work affects business decisions, rather. In order to migrate to canada as a qualified accountant under noc code 1111, you’ll need chartered or regulated status in your home country. Ca (chartered accountant) the ca designation required an undergraduate degree in accounting plus three years of training in a designated accounting firm.

Money and the world virtual conference 2022. Individuals can choose financial accounting,. Then, they enter the canada.

Northern manitoba, including the cities of churchill, flin flon, norway house, swan river and thompson, is where accountants are paid the highest average salaries in the province. Society of professional accountants of canada (spac) awards the registered professional accountant (r.p.a.) credential to qualified applicants. Steps to become an accountant in canada step 1.